Mortgage calculator with extra monthly and annual payments

A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might. Pay this Extra Amount.

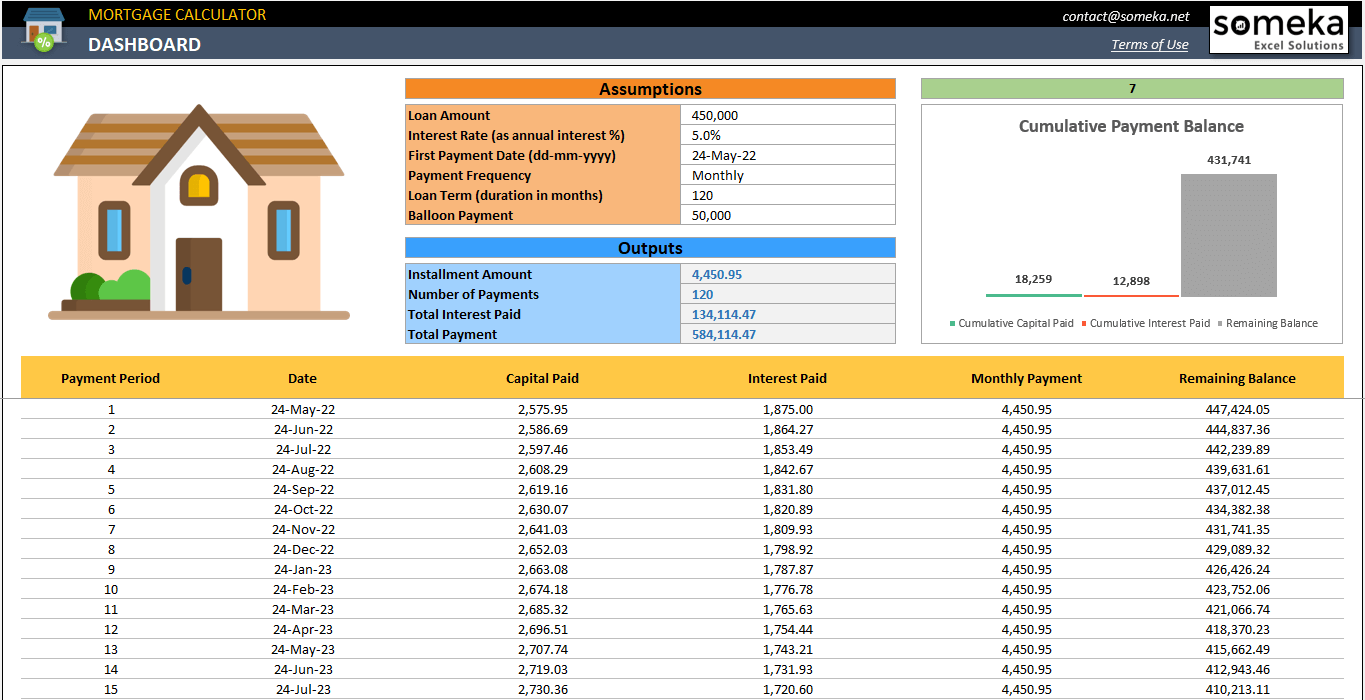

Extra Payment Mortgage Calculator For Excel

Why you need a wealth plan not a financial plan.

. Try one or all of the following tips to get a smaller monthly mortgage payment. Advanced fields include payment frequency compound frequency and payment. The calculator is mainly intended for use by US.

Connect with our friends at Clever Real Estate for a local agents expert opinion and a free. On a regular monthly plan borrowers only make 12 payments a year. FHA mortgage calculator to calculate monthly payment along with Upfront Annual MIP Taxes Home Insurance Extra Payments on your FHA loan.

As a result by the end of the year youll pay an equivalent of 13 monthly payments. Before taking a fortnightly option be sure to arrange it with your lender first. If you pay every 2 weeks thats 26 half payments.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Fortnightly payments follow the 52-week calendar year instead of the 12-month timetable.

It offers stability by making it easier to anticipate and budget monthly payments. Mortgage Amount or current balance. Having a fixed rate ensures your monthly payments do not change during the agreed period.

Bi-Weekly plus Extra Avg. Simply add the extra into the Monthly Pay section of the calculator. Welcome to our commercial mortgage calculator.

Meanwhile there are 52 weeks in a year. The calculator allows you to enter a monthly annual bi-weekly or one-time amount for additional principal prepaymentTo do so click Prepayment options Lets say for example you want to pay an extra 50 a month. Also this calculator has the ability to add an extra amount extra payment to the monthly mortgage and turbo charge your interest savings.

Making extra payments can drastically reduce your loan term and save you a tremendous amount on interest charges. Fill out the other important data taxes start date PMI etc only if they are different then the default data in the mortgage payment calculator and hit enter. Make more frequent payments.

Conforming Fixed-Rate estimated monthly payment and APR example. A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in an estimated principal and interest monthly payment of 99472 over the full term of the loan with an Annual Percentage Rate APR of 3444. Meanwhile 10-year fixed-rate mortgages are initially more expensive but they provide more financial security with predictable payments.

How to lower your monthly mortgage payment. It helps to add up all of your income sources and compare. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan.

Estimated monthly payment and APR calculation. To use this calculator just enter the original mortgage principal annual interest rate term years and the monthly payment. 360 original 30-year term Interest Rate Annual.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. This calculator will calculate the weekly payment and associated interest costs for a new mortgage. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

Our calculator includes amoritization tables bi-weekly savings. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Whatever the frequency your future self will thank you.

Smart digital tools like the mortgage rate estimator allow prospective homeowners to explore a variety of pricing and rate options run different scenarios and really get a grasp on potential costs and payments. It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months.

Choose the longest term possible. A 30-year fixed-rate loan will give you the lowest payment compared to other shorter-term loans. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules.

Because you make payments every 2 weeks this results in 26 half payments which is equivalent to 13 monthly mortgage payments. Now use the mortgage payment calculator to see how prepaying some of the principal saves money over time. Our condo mortgage calculator saves you time while helping you to determine the financial implications and monthly repayments.

Your principal and interest payments will drop with a smaller. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. This Bi-Weekly Mortgage.

Then our free mortgage calculator will give precise data about monthly principal interest a number of total payments the total interest that you need to pay and payout date. You can significantly reduce your debt without feeling pinched by making biweekly mortgage payments. Use our extra mortgage payment calculator to see how fast you can pay off your mortgage with additional monthly payments.

If you have any trouble understanding any of the fields hover over the field for a description of the value requested. Then choose one of the three options for calculating the number of mortgage payments made leave two of the options blank to determine the remaining balance. Make a bigger down payment.

Thats one extra monthly payment a. Here you can calculate your monthly payment total payment amount and view your amortization schedule. Check out the webs best free mortgage calculator to save money on your home loan today.

Our condo mortgage calculator takes into account the loan principal number of payments per year interest rate and other costs associated with the mortgage. By making additional monthly payments you will be able to repay your loan much more quickly. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments.

Fha Mortgage Calculator With Monthly Payment Fha Mortgage Mortgage Loan Calculator Mortgage Amortization Calculator

Debt Snowball Calculator Debt Snowball Calculator Interest Calculator Mortgage Payoff

Bi Weekly Mortgage Calculator Extra Payment Amortization Table Mortgage Payoff Amortization Schedule Mortgage Payment Calculator

Sdj0vcpuql1c7m

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

Mortgage Repayment Calculator

Monthly Loan Amortization Schedule Excel Template Amortization Schedule Excel Templates Loan Calculator

Home Loan Comparison Spreadsheet Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Comparison Spreadsheet Refinancing Mortgage Calculator Etsy Refinancing Mortgage Mortgage Calculator Mortgage

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Mortgage Calculator Calculate Mortgage Payment Tables And Total Costs Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Amortization Spreadsheet With Extra Payments Amortization Schedule Budget Spreadsheet Spreadsheet

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Mortgage Calculator Amortization Schedule Mortgage Rates